Finding Your "Chipotle" Moment: Investing with a Margin of Safety

The Power of Patience in Value Investing

The concept of a "margin of safety" is a cornerstone of value investing, championed by legendary investors like Warren Buffett and Benjamin Graham. Essentially, it involves purchasing assets at a significant discount to their intrinsic value, creating a buffer against unforeseen risks.

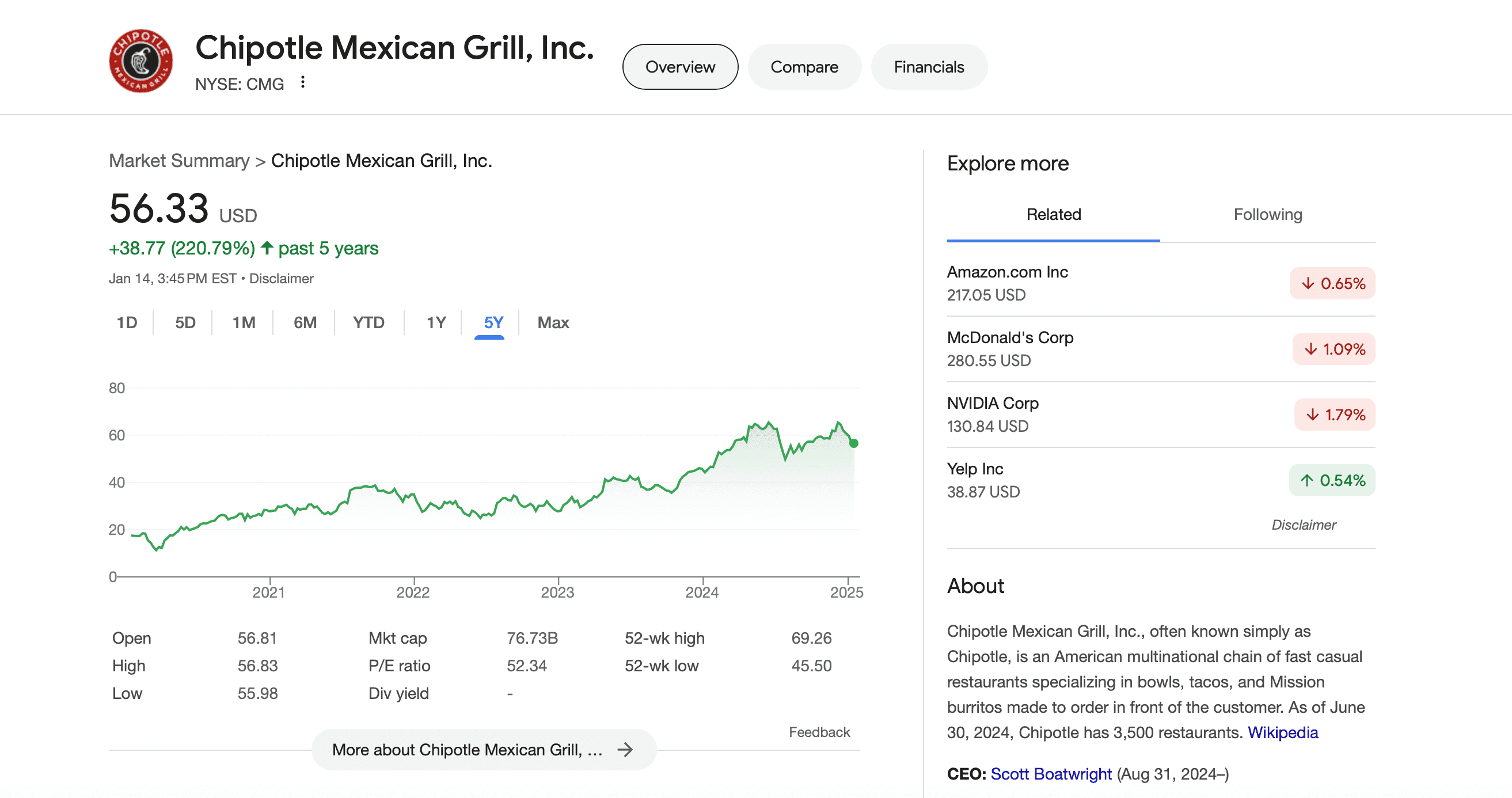

Let's illustrate this with a real-world example: Chipotle Mexican Grill.

A Classic Case of a Margin of Safety

Chipotle, a beloved fast-casual restaurant chain, faced a severe crisis in 2015 due to an E. coli outbreak. This food safety scare sent shockwaves through the company, plummeting its stock price from a high of $760 per share to a low of $250.

At first glance, this might seem like a disaster. However, for value investors, it presented a unique opportunity.

Understanding the Fundamentals: Chipotle, even with the crisis, remained a fundamentally strong company with a loyal customer base and a proven business model.

Recognizing the Discount: The drastic stock price decline offered a significant discount to the company's intrinsic value.

Capitalizing on the Opportunity: Investors who understood the temporary nature of the crisis and recognized the long-term potential of Chipotle were able to capitalize on this "sale," buying shares at a fraction of their previous price.

The Importance of Patience

While finding companies trading at a significant discount to their intrinsic value is ideal, it's not always easy. Most of the time, great companies are not "on sale."

This is where patience becomes a crucial virtue for value investors. As Charlie Munger famously said, "Make money while we wait."

Building a Watchlist: Instead of chasing fleeting opportunities, value investors often compile a "watchlist" of high-quality companies that they admire.

Cultivating Patience: They patiently monitor these companies, waiting for the market to misprice them due to temporary setbacks, negative news, or irrational exuberance.

Reaping the Rewards: When the market finally presents an opportunity – a significant discount to intrinsic value – they are ready to pounce, capitalizing on the mispricing.

The Four M's For Successful Investing

How to invest with certainty in the right business at the right price

Warren Buffett's Approach to "Laziness"

Warren Buffett himself emphasized the importance of patience in investing, often describing his approach as "laziness bordering on sloth."

Focus on Long-Term Value: Buffett and his partner, Charlie Munger, focus on identifying companies with enduring competitive advantages and strong long-term prospects.

Minimizing Trading Activity: They avoid frequent trading and unnecessary activity, preferring to hold onto high-quality companies for the long term.

Embracing Patience: They understand that true investment success often comes from patiently waiting for the right opportunities and avoiding the temptation to chase short-term gains.

Conclusion

The Chipotle example highlights the power of the margin of safety principle and the importance of patience in value investing. By identifying and patiently waiting for undervalued opportunities, investors can significantly enhance their chances of long-term success. Remember, true investment wisdom often lies in understanding that the best returns often come from doing nothing – or rather, from patiently waiting for the right moment to act.